We take the stress off your shoulders, so you can focus on success.

Get Your Life Back

Through Our Straightforward

Bankruptcy Process:

Step 1: Free Consultation

- Discuss your options with our experienced Bankruptcy Attorneys.

- No cost. No obligation. No judgment.

Step 2: Retain our Office (deposit)

- We pull your Credit Report.

- You provide us with additional required information and documents.

- Take Credit Counseling Course.

- Make final payment.

- We make sure everything is prepared– no surprises when we get to Court!

Step 3: Sign and File Case

- Together we review and sign for filing.

- We file your case electronically.

- The Automatic Stay (no more collections!) starts as soon as the case is filed.

Meet Our Team

Malissa L. Walden

Malissa is a native Kansan with an international perspective. After years of living abroad, she returned to pursue her life-long dream of helping others through the practice of law. Her focus is on asset protection for her clients through Chapter 7 and Chapter 13 Bankruptcy filings and Student Loan Debt assistance. She is proud to be able to see her clients reap the benefits of real change.

Cassie Pfannenstiel Rodriguez

Cassie is proud to help individuals and families protect their assets by providing debt relief and estate planning options. She understands everyone is facing a different situation and talking through how legal options can help or not is essential for people to make an educated decision regarding their future. She is always struck by how brave and strong people are in the face of difficult and stressful circumstances.

Your Connection to Your Case

Three Things You’ll Get When You Hire Walden & Pfannenstiel

Our Pathway

We are passionate about helping our Clients accomplish and celebrate life altering change.

![]()

Money Can’t Buy You Love

Romance In The Air – Love So True … Ah, [...]

April 1, 2024 Median Income Levels for Kansas and Missouri Bankruptcy Filers

April 1, 2024 Median Income Levels for Kansas and Missouri [...]

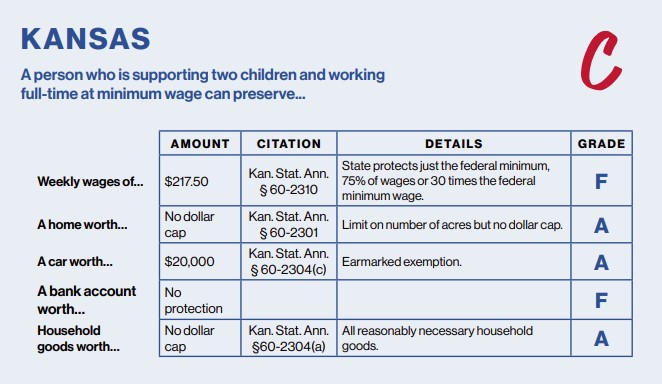

Is a Fresh Start Possible When the State Works Against You?

Families and Poverty -- How Can Your State Protect You [...]