Money Can’t Buy You Love

Romance In The Air – Love So True … Ah, April Fools … It’s not nice to play tricks on people. Especially tricks of the heart. The dating world is different today than it was many years ago. Statistics show that U.S. adults are getting married later in life and that most people who are [...]

April 1, 2024 Median Income Levels for Kansas and Missouri Bankruptcy Filers

April 1, 2024 Median Income Levels for Kansas and Missouri Bankruptcy Filers The Means Test looks at your Median Income to determine for which Chapter of Bankruptcy you qualify: Chapter 7 or Chapter 13 Most individual debtors filing for bankruptcy relief are required to complete a version of Bankruptcy Form 122. On April 1, 2024, [...]

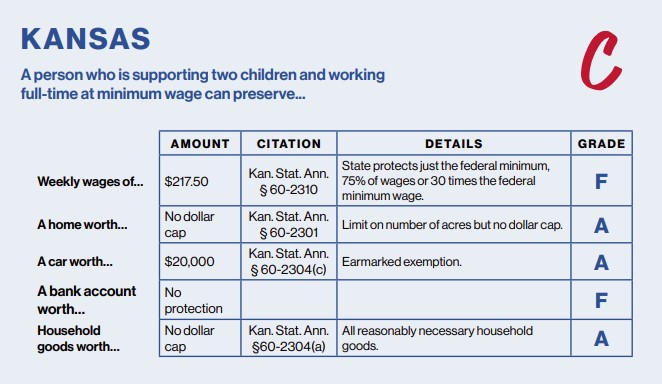

Is a Fresh Start Possible When the State Works Against You?

Families and Poverty -- How Can Your State Protect You … Fresh Start 2024. A report from the National Consumer Law Center (NCLC) shows how states lack in offering assistance and protection to its citizens. Every state has a set of exemptions that allow one to avoid losing everything to the creditors. Per the NCLC [...]

What does pre-petition debt vs post-petition debt mean?

Pre-petition debt – Post-petition debt … What do they mean? It all comes down to when you incurred the debt. Meaning, what is the date that you bought something, charged something, or borrowed funds. Why do we care? In bankruptcy cases, the ‘when’ of these actions is a big deal. It can mean the difference [...]

Bankruptcy Alternatives You May Consider : Know Your Financial Options

No Bankruptcy – Consider the Alternatives … Bankruptcy vs Other Financial Options: Have you ever been stressed and overwhelmed by your debt situation? Have you ever wondered if bankruptcy would be right for you? Have you ever considered if there were other options you could try? Have you ever decided that bankruptcy should only be [...]

Navient Student Loan Class Action Suit ** UPDATE **

Navient — Student Loan Debt… Class action suit. (original post 11/9/23) Navient Class Action Suit ** UPDATE ** As additional questions keep coming in regarding this class action suit, here is an update: The matter of Youssef v. Navient Solution; Case No. 23-MC-2113 (HG), Adv. Pro. No 17-1085 has been settled. The proposed [...]

Adjunct Professor of Bankruptcy Law: Malissa L. Walden

Adjunct Faculty -- Professor of Law: KU Law School... You may be wondering what an adjunct actually is and what one does. We are a professor employed by a college or university for a specific purpose or length of time and often part-time. Starting in a few days, I will be teaching as such at [...]

Your Federal Student Loan Has Been Forgiven

Debt -- Student Loans, Forgiven... How would you feel if someone told you that all of your student loan debt has been forgiven? I can only imagine what a relief (or disbelief) that must be! Finally (and yet somewhat out of the blue) all of the stress about finances, worry, fear and pressure are gone. [...]

NAVIGATING OVERWHELM: A JOURNEY TO EMPOWERMENT

NAVIGATING OVERWHELM: A JOURNEY TO EMPOWERMENT -- by Michele Gooch ... I read this post this week and knew I had to share it. I think we have all been there, wading through the overwhelm. I appreciate the practical steps provided. Now, I just have to remember to keep the tools in my back pocket [...]