Is a Fresh Start Possible When the State Works Against You?

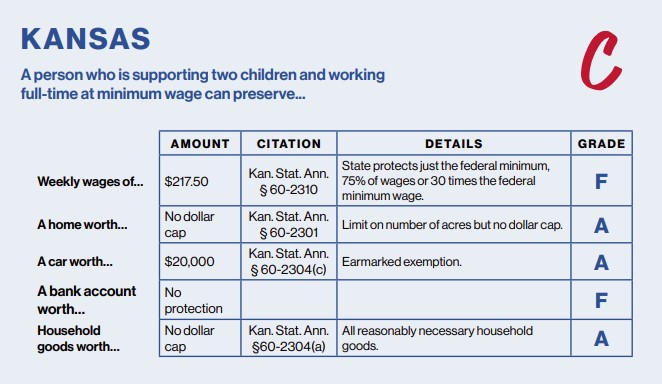

Families and Poverty -- How Can Your State Protect You … Fresh Start 2024. A report from the National Consumer Law Center (NCLC) shows how states lack in offering assistance and protection to its citizens. Every state has a set of exemptions that allow one to avoid losing everything to the creditors. Per the NCLC [...]