Car Debt:

Negative equity –

Finance trap.

Pandemic Vehicles

If you looked at cars at all during pandemic, you know it wasn’t good. It wasn’t just the new cars though. Used car prices that really soared! We happened to be in the market for a vehicle for our teen during this time. I have to say, it was painful. Used car prices were inflated due to demand (although they didn’t drive or smell any better) and you had to be put on a wait list for a new car.

Negative equity

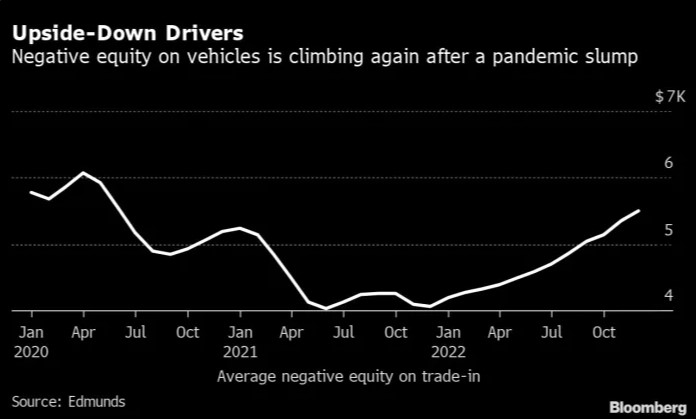

The cost of new vehicles has risen 20% since the start of the pandemic and used vehicles are still up 37%. This continued surge in price and a prevalence of 84-moth loans has left many with a build-up of negative equity. In other words, the amount of debt exceeds the vehicle’s value. We all know that a new car loses value as soon as it has been driven off the lot – that isn’t what we are talking about. This is a situation where drivers are $10,000+ upside down on their loans.

Debt Cycle

The average monthly payment for a new vehicle is $1000 or more. While this is out of reach for many, lack of transportation is not an option. So, many continue to borrow and lenders extend the length of auto loans to lower monthly payments. Overtime, this will result in further negative equity and possible required trade-in – adding more to an already underwater loan.

Feeling Stuck

Refinancing isn’t an option as there is no equity. Trade-in, puts you more upside down in your next loans. Interest rates are higher than they have been on previous loans. If the debt you’ve amassed makes you feel uneasy, you aren’t alone. Our vehicle’s (negative) worth does not define us, but we can take steps to climb out of the pandemic slump.