Chapter 13 Bankruptcy:

Plan Payments . . .

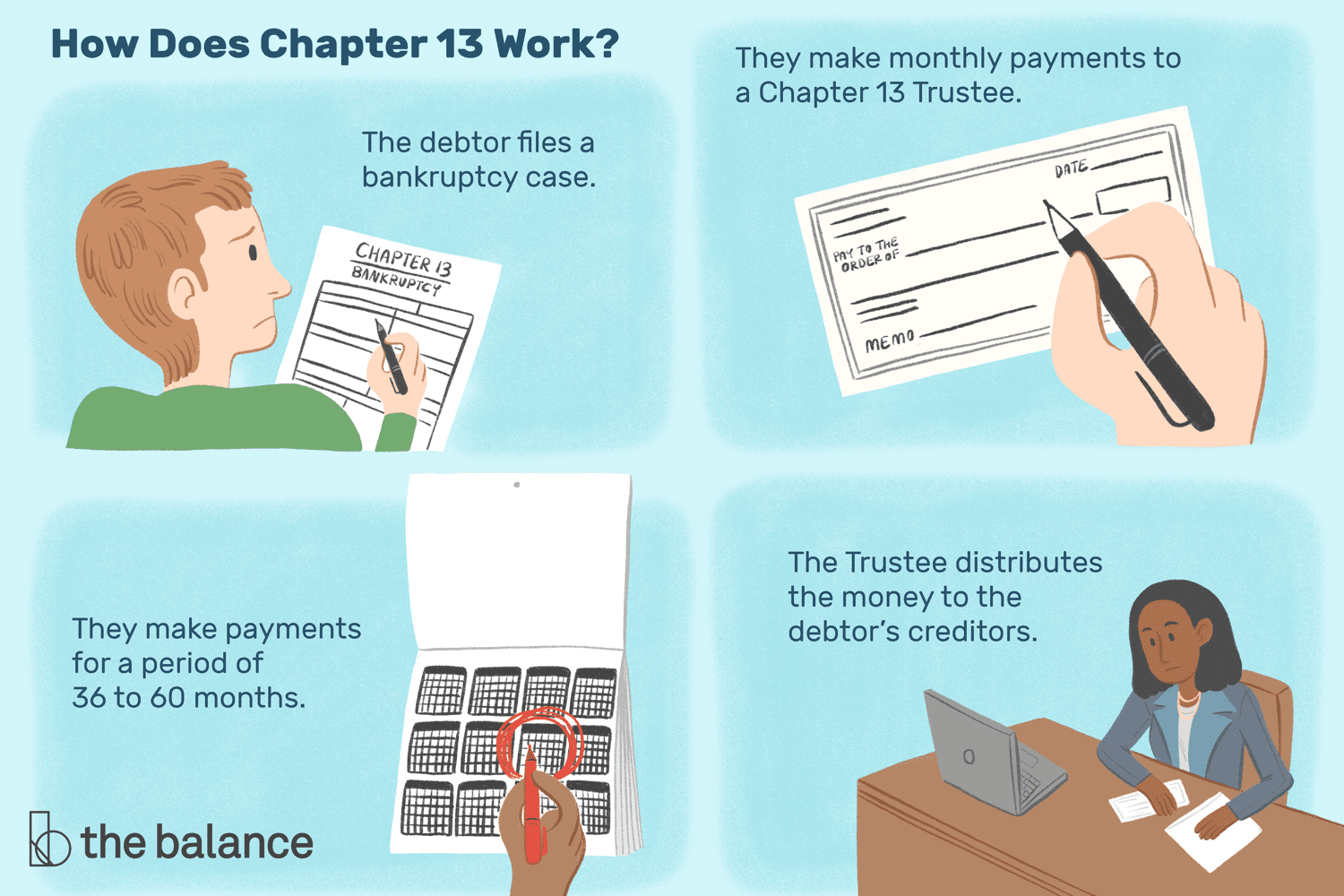

What is the Process —

Chapter 13 bankruptcy, often called a “reorganization bankruptcy,” allows you to keep your assets while paying off your debts over time.

The Chapter 13 Repayment Plan

When you file for Chapter 13 bankruptcy, you propose a repayment plan to the court. This plan details how you’ll pay off some or all of your debts over three to five years. The length of your plan typically depends on your income:

- Three-Year Plan: If your income is below your state’s median income, your repayment plan will likely last three years.

- Five-Year Plan: If your income is above the median, your plan will generally be five years.

Monthly Payments

Your monthly payment amount is based on your income, expenses, and the total amount of debt you owe. The payment is typically made to a court-appointed trustee, who distributes the funds to your creditors. The goal is to pay off as much of your debt as possible while leaving you enough income to cover your living expenses.

Priority, Secured, and Unsecured Debts

Chapter 13 payments are divided among different types of debts:

- Priority Debts: These debts, such as child support, alimony, and certain taxes, must be paid in full during the plan.

- Secured Debts: These are debts backed by collateral, like your mortgage or car loan. You may need to pay these in full or continue making regular payments outside the plan. In some cases, you might be able to reduce the balance owed on certain secured debts (a process called “cramdown”).

- Unsecured Debts: Debts like credit card balances and medical bills fall into this category. You’ll pay these after priority and secured debts, and the amount you pay may be reduced based on your income and assets. If you successfully complete your plan, any remaining unsecured debt may be discharged.

Adjustments and Changes

Your Chapter 13 plan isn’t set in stone. If your financial situation changes during the repayment period—such as losing a job or incurring unexpected expenses—you can request a modification to your plan. The court will review your new circumstances and may adjust your payments accordingly.

Completing Your Plan

Once you make all the required payments under your Chapter 13 plan, any remaining dischargeable debts will be wiped out, giving you a fresh financial start. Completing your plan is key to getting your debts discharged and moving forward with your financial life.

While the Chapter 13 payment process can seem complex, it offers a structured way to manage and eventually eliminate your debt. Working with a bankruptcy attorney can help you create a repayment plan that fits your budget and ensures you meet all legal requirements.