Families and Poverty —

How Can Your State Protect You …

Fresh Start 2024.

A report from the National Consumer Law Center (NCLC) shows how states lack in offering assistance and protection to its citizens. Every state has a set of exemptions that allow one to avoid losing everything to the creditors. Per the NCLC Report, few state exemptions meet basic standards for citizens.

Ways states could help families get a fresh start:

Living Wage

Families must have enough money to live. To protect families, we must prevent creditors from seizing so much of the consumer’s wages that the consumer is pushed below a living wage. A ‘living wage’ means a wage of at least $1,000 per week. This should be more in high-cost states. Additionally, it should be for all working debtors — including those paid as independent contractors. These are the funds that allow families to meet basic needs and maintain a safe, decent standard of living within the community.

Have A Vehicle

One is unable to work if there is not enough protection of a working car, work tools, and work equipment. The states need to allow the consumer to keep a used car of at least average value.

Keep Household Items

To preserve a basic standard of living, creditors must be preventing from seizure and sale of consumer’s necessary household goods. That also includes closing loopholes that enable some lenders to evade exemption laws. For example, states that allow lenders to take household goods as collateral enable these lenders to avoid state protections of household goods.

Keep A Home

Preserving the family’s home—at least a median-value home is essential to protecting consumers. Without their home, consumers have no chance of meeting their basic needs or maintaining a safe, decent standard of living within the community.

Preserve Bank Account Funds

If a state allows creditors to extract all funds from consumers bank account, there is no possibility of a consumer to be able to pay essential costs such as rent / mortgage, utilities, and commuting expenses. It is necessary to automatically protect a reasonable amount of money on deposit so that families have a cushion to cover several months of basic needs. When accounts are cleaned out, consumers cannot pay their rent mortgage, daycare, utility bills, medical needs, or vehicle expenses. In addition, there needs to be protection for retirees from destitution by restricting creditors’ ability to seize retirement funds. These preserved bank account funds need to be automatically updated for inflation

Best States:

- Arizona

- Nevada

- New Mexico

- North Dakota

- Washington

Worst States:

- Georgia

- Kentucky

- Michigan

- New Jersey

- Utah

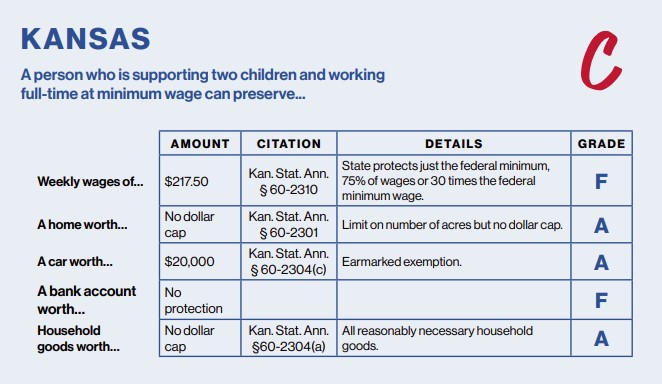

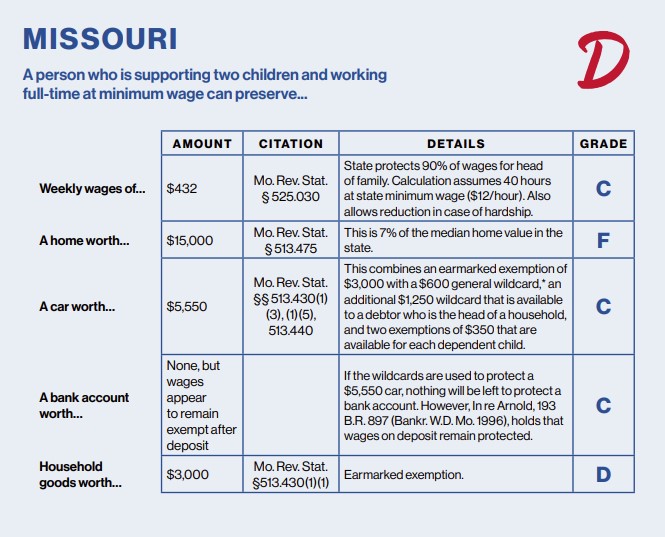

Kansas and Missouri

According to the Report, Kansas received a C and Missouri a D. This is not surprising to anyone that is familiar with the different exemptions afforded these two states.

*MO has a “wildcard” -- it is an exemption that is not limited to a particular category of property, but can be used to protect items of the debtor’s choice. This summary is based on state exemption laws, other than those that apply only in bankruptcy court. Federal minimum wage is $7.25 an hour.*

If you are struggling with debt, protections are available – but as you’ve seen they are state specific. They are also often not self-enforcing to any great extent. This can require consumers to file complicated papers and attend court hearings.

Luckily you do not have to face any of this alone.