Living Day-By-Day

Robbing From The Future —

Hurting Ourselves.

Robbing Peter to pay Paul. This well-known expression dates back to at least the 16th century. Most sources agree that it refers to the two apostles. It could be in reference to the collection of taxes. A more widely held thought is that it derives from the shared feast day of St. Paul and St. Peter. Both Peter and Paul share June 29th as their Saint’s Day – and thus, robbing one feast to pay for the feast of the other, is pointless.

But what happens when Paul (your debt) has to get paid?

We can’t get ahead when we have to make it one day at a time. We certainly can’t save with inflation and the turmoil of this economy.

So, when a financial emergency happens – it only makes sense that we turn to any funds we may have available: retirement.

And so we become Peter.

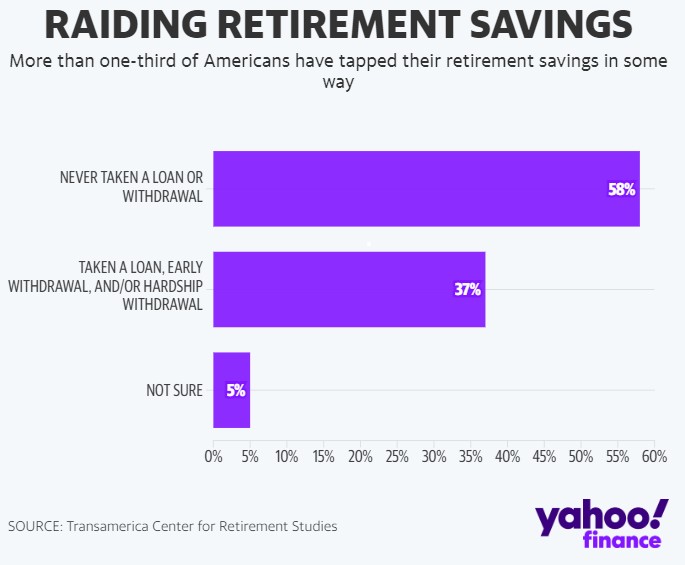

A survey by nonprofit Transamerica Center for Retirement Studies (TCRS) in collaboration with the Transamerica Institute found that 37% of workers have taken a loan, early withdrawal or a hardship from a 401k or similar account.

According to Catherine Collinson, CEO and president of Transamerica Institute and TCRS,

“The pandemic and last year’s turbulent economy with high inflation and falling stock markets took a toll on workers’ employment, finances, and retirement preparations. Without extra support from policymakers and employers, it will be extremely tough for many workers to recover.”

Who is taking out their funds:

- Gen Z; 28%

- Millennials; 24%

- Gen X; 19%

- Baby Boomers; 12%

Top reasons for retirement withdrawals:

- Medical expenses 17%

- Prevent eviction 16%

- Disaster expenses 15%

- Tuition 14%

- Buy a home 13%

- Home repairs 12%

- Funeral expenses 6%

Top reasons for a 401k loan:

- Financial emergency 31%

- Debt 30%

- Everyday expenses 26%

- Medical bills 25%

- Home improvements 23%

- Buy a car 19%

- Unplanned major expenses 19%

The average loan is $5100.

During our intake process we always ask if one has a 401k / retirement plan. We also ask if they have taken any funds out it in the last year.

As a bankruptcy attorney, I am always happy when a potential client reports that they do have a retirement account and they have not taken out any money. This is like music to my ears!

We can protect their retirement account through exemptions in their case. I know that they will be in a better place in the future because they will leave their case debt free and with their future savings.

All too often, people struggle for far too long before speaking with our office. They get into a debt cycle. They pay what they can. They rob from themselves and then they reach out. While we wish we could have advised them from the start, we are just glad when they do take action. In the end, they will be in a better place – ready to move forward, pick up the pieces and start saving.