Student Loan Debt Relief: Feelings vs Facts

It’s been one week since Biden announced his Student Loan Debt Plan.

What have you been hearing?

“I’ll take it, but is it going to affect my life that much? Not in the long run…” ~Amanda Connelly (currently has $85,000 in loans and is getting ready to take out $15,000 more)

“If you borrow, and sign, you owe. That simple. A slap in the face to all who have met their financial obligations and paid back their loan. This will cost taxpayers hundreds of billions of$$$.” ~Ward Burgess.

“My loans more than likely do not qualify as they are privately held. However, I am happy for those who are able to benefit from this.” ~April Moore

“Such a relief to middle and lower class borrowers who were promised that college was the path to upward mobility!!” ~Jacquelyn Rybak

“You need to do something about the high interest rates!!!” ~Sabrina Mark

There has been a lot of feelings about the forgiveness – what about the facts?

- The cost of attending college has skyrocketed, but federal support has not kept pace. The typical undergrad now has $25k in debt at graduation.

- There are more than 45 million borrowers currently holding $1.6 TRILLION in student loan debt.

- The Student Loan Debt Relief facts:

- Repayment on student loans will start in 2023

- $10,000 to be forgiven is you did not receive a Pell Grant

- $20,000 to be forgiven if you received a Pell Grant – nearly all Pell grant recipients come from families with incomes of $60,000 or less.

- Forgiveness applies to those with earnings less than $125,000 (individual)

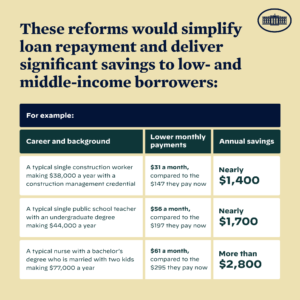

Monthly payments will be cut in half (5% of borrower’s discretionary income)

Monthly payments will be cut in half (5% of borrower’s discretionary income)- Fixing the PSLF program to allow proper credit to be applied towards loan forgiveness

- Working towards protecting future students and tax payer by reducing the cost of college and holding schools accountable when they raise their prices.

- Borrowers of all ages – more than 1/3 are over 40 and 5% are senior citizens.

- If you recently paid off your student loans and would have been eligible for forgiveness, you may be able to get those funds back.

With those facts, will it be enough?

As Amanda was quoted, the funds being forgiven aren’t going to change her day-to-day. She has too much debt that will survive. We see a lot of our clients in that same situation.

I do believe that the payment extension through the end of the year and the reduction to 5% of their income for repayment may make a difference for them though.

Time will tell. Interest rates, cost of education – those are certainly factors. In the meantime, we continue to deal with inflation and our current economy and just trying to put food on the table and gas in our cars.

The struggle is real. Remember that relief is also possible.

***

More information on claiming relief will be available to borrowers in the coming weeks.

Borrowers can sign up to be notified when this information is available at StudentAid.gov/debtrelief.