Scams

Fraud

The duped consumer.

As of 2022 the Federal Trade Commission reported 2.4 MILLION fraud reports and losses of more than $8.8 billion.

You Know Me!

The number one scam category: imposter scams. These types of scams involve criminals pretending to be a trusted organization such as a bank, the police or a government department. You’ll get a phone call, text message or email that appears to be from a trusted organization or person.

According to the FTC, a notable trend relates to the rise of business imposters – scammers who falsely claim affiliations with well-known companies. In 2020, reported losses to business imposters was $196 million. That figure rose to $453 million last year and soared to $660 million in 2022. The Internal Revenue Service continues to be the #1 for the imposter scam.

Latest Scams:

- The “pig butchering” scam.

- Damaged used cars sales.

- Google Voice verification code scams.

- Zelle, Venmo, and Cash App Scams.

- Robocalls attempting to steal 2FA codes.

- Work-from-home scams.

- Amazon imposter scams.

- Crypto recovery services

- Tech support scams

- Student loan forgiveness scams:

According to the Federal Student Aid, an office, of the U.S. Department of Education (ED), they may reach out about your student loans and provide information about programs. However, it will never provide aggressive language or advertise its service.

Claims you may see from a scam:

- “Act immediately to qualify for student loan forgiveness before the program is discontinued.”

- “Your student loans may qualify for complete discharge. Enrollments are first come, first served.”

- “Student alerts: Your student loan is flagged for forgiveness pending verification. Call now!”

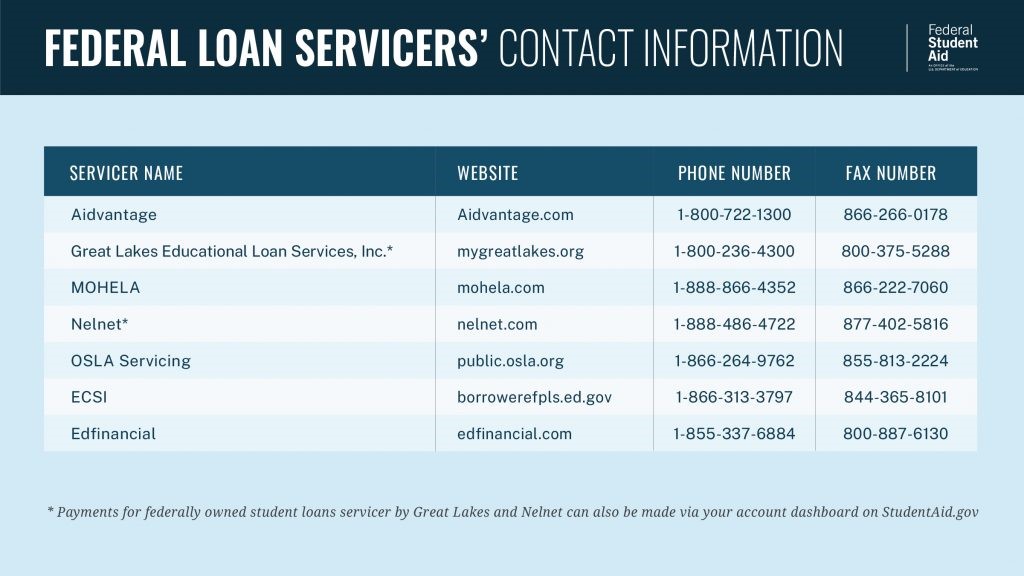

If you aren’t sure who are dealing with you can review ED’s website or contact your servicer directly:

If you know you’ve been scammed, they recommend the following:

- act fast and pursue one or all of these options:

- Contact your federal loan servicer to make sure no unwanted actions were taken on your loans (or to revoke any authorization agreement that your servicer has on file).

- Contact your bank or credit card company to stop all payments to the company that is scamming you.

- Submit a complaint to ED.

- File a complaint with the Federal Trade Commission (FTC).

- File a complaint with the Consumer Financial Protection Bureau (CFPB)

In The News:

In a press release on May 8, 2023, the FTC announced halting two student loan debt relief schemes.

In these cases, the debt relief scammers:

- impersonated the Department of Education

- one used fake COVID-19 relief programs

- stole a combined total of more than $12 million dollars

- used the federal student loan pause, when borrowers generally weren’t in contact with their loan servicers, to get people to sign up for bogus debt relief repayment plans

- had borrowers paying more money to them than they would’ve paid to their actual loan servicers

- lied to borrowers, said they had taken over servicing their loans

- charged illegal upfront fees

- said fees would be applied to reduce loan

- threatened borrowers with things like loan default when refunds were requested

Getting Loan Help

Do you have to pay for assistance with your student loans?

Of course not. Just like many other things in life (taxes, buying/selling a home, legal matters, building a deck, repairing an engine…), you can take care of them on your own and there are other free resources available.

If you have federal student loans, start at StudentAid.gov/repay. If your loans are private, go directly to your loan servicer.

Of course, there are, moments in life when seeking a professional’s service makes sense. For student loans, you may wish you speak with an attorney to see what opportunities are available in your situation.

How can a Student Loan Lawyer Help?

-

- Lower your monthly payments

- Determine if your loan may be discharged in bankruptcy

- Evaluate and implement federal loan consolidation strategies

- Identify repayment options for which you can qualify

- Assess forgiveness programs based upon your career

- Recognize circumstances in which you are eligible for partial or complete forgiveness

- Stop lawsuits, garnishments and loss of benefits