Buy Now, Pay Later —

Borrower Profiles:

It’s not what we thought.

What is Buy Now, Pay Later?

Buy now, pay later (BNBL) is a type of short-term financing that allows consumers to make a purchase and pay for it over time. When they finish shopping online and get to checkout they can break up their total purchase, pay a small amount now and the rest of their purchase can be paid in equal installments over time.

What makes BNBL appealing?

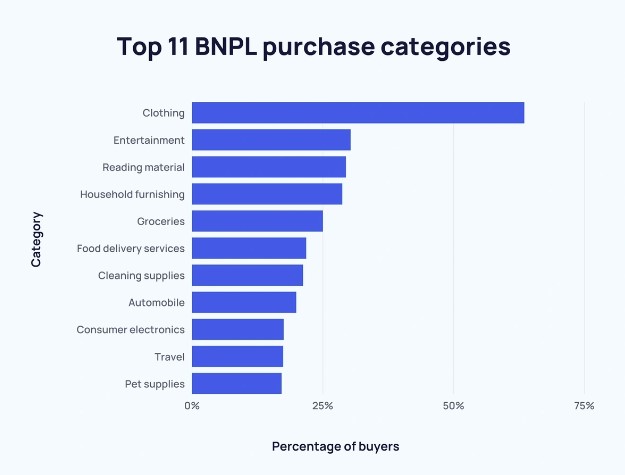

Advertised interest rates. Interest rates may be 0% if you make your payments on time. If you miss a payment; however, it can jump to 36% — along with a late fee. In addition to the potential appealing interest rate, there is no credit score needed for a plan. You can also now use BNBL at most major retailers. (The number one item purchased is clothing)

Who uses BNBL?

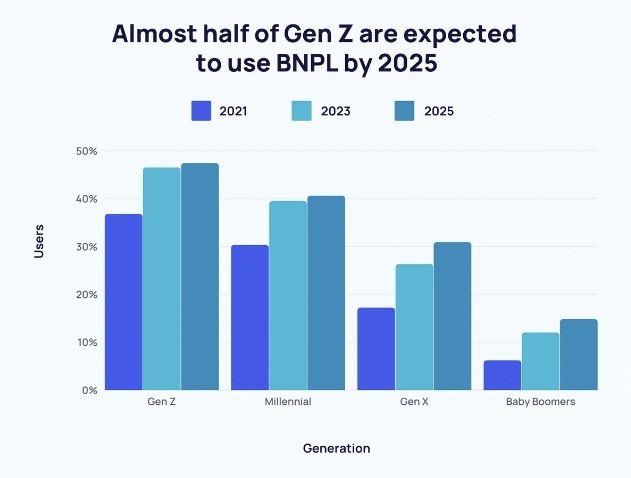

Gen Z is the generation that uses BNBL the most. There are currently around 360 million users. All of these numbers are expected to grow, as it is a global market. Interestingly, it has been believed that users of BNBL were those that were unable to access other types of credit. However; a recently published Report by Consumer Finance found that were MORE likely to be using credit cards, payday loans, and other high-interest financial services.

Report Findings Include:

- Nearly 95% of Buy Now, Pay Later borrowers had at least one credit record in another account, compared to 86% of non-borrowers.

- Buy Now, Pay Later borrowers had significantly higher usage in several other loan products when compared to non-borrowers, including retail accounts (62% compared to 44%), personal loans (32% compared to 13%), and student loans (33% compared to 17%).

- Black, Hispanic, and female consumers are more likely than average to use Buy Now, Pay Later products, along with consumers with income between $20,001-$50,000.

- Among consumers who have open credit or retail cards, personal loans, auto loans, student loans or mortgages, Buy Now, Pay Later borrowers were more than twice as likely to be delinquent on at least one of those products by 30 days or longer.

- Eighteen percent of Buy Now, Pay Later borrowers had at least one reported delinquency in another account, compared to 7% of non-borrowers. Delinquency rates were substantially higher for credit (9%) and retail cards (8%) among Buy Now, Pay Later borrowers compared to non-borrowers (3% and 1% respectively).

Why You Borrow?

You need to be your own filter. Not all debt is bad. You may gain some benefits with 0% interest, an extended payment plan or gaining credit card points – you need to know the risks going in. Know your financial situation and what you will be able to pay (now or later).

Did You Miss Payments?

If you have already missed some payments, you are not alone. According to LendingTree, 42% of consumers who use BNPL have made at least one late payment. If you get off track, it can affect your credit score. They are, at the end of the day, a loan. Which means, just like other types of debt, can spiral and get you in a cycle that seems too much to manage. These trickly loans can become too good to be true, but you always have an opportunity to move forward.